The Virtual Cards Market Report highlights the rapid adoption of digital payment technologies transforming card-based transactions. Virtual cards are driving secure payment systems, facilitating online transactions, temporary card usage, and innovative virtual banking solutions. This market is gaining momentum as businesses and consumers increasingly prefer contactless, efficient, and secure digital card services. Digital payment, card-based transactions, and virtual banking adoption are key factors propelling this growth.

Expanding Scope of Virtual Card Solutions

Virtual cards are revolutionizing financial operations by providing secure, flexible, and controlled payment options. Temporary cards reduce fraud risk in online transactions, while integration with virtual banking platforms streamlines corporate and individual payments. This evolution reflects a broader shift toward automated financial systems and enhanced digital payment experiences.

Technological Drivers and Market Growth

Technological advancements, such as AI-powered fraud detection, tokenization, and encrypted digital platforms, have made virtual cards a preferred choice in modern banking and fintech ecosystems. The US Personal Loans Market exemplifies how digital integration and secure payment technologies are reshaping lending and credit disbursement, while the France Core Banking Solutions Market demonstrates improvements in backend banking efficiency, enhancing virtual card deployment and transaction monitoring.

Key Trends Influencing the Virtual Cards Market

Rising e-commerce adoption, digital-first banking, and regulatory support for secure online transactions are fueling market expansion. Virtual cards facilitate real-time payments, minimize exposure to fraud, and provide temporary, one-time-use solutions that appeal to both consumers and enterprises. Increasing reliance on virtual banking platforms also encourages innovation in secure digital payment ecosystems.

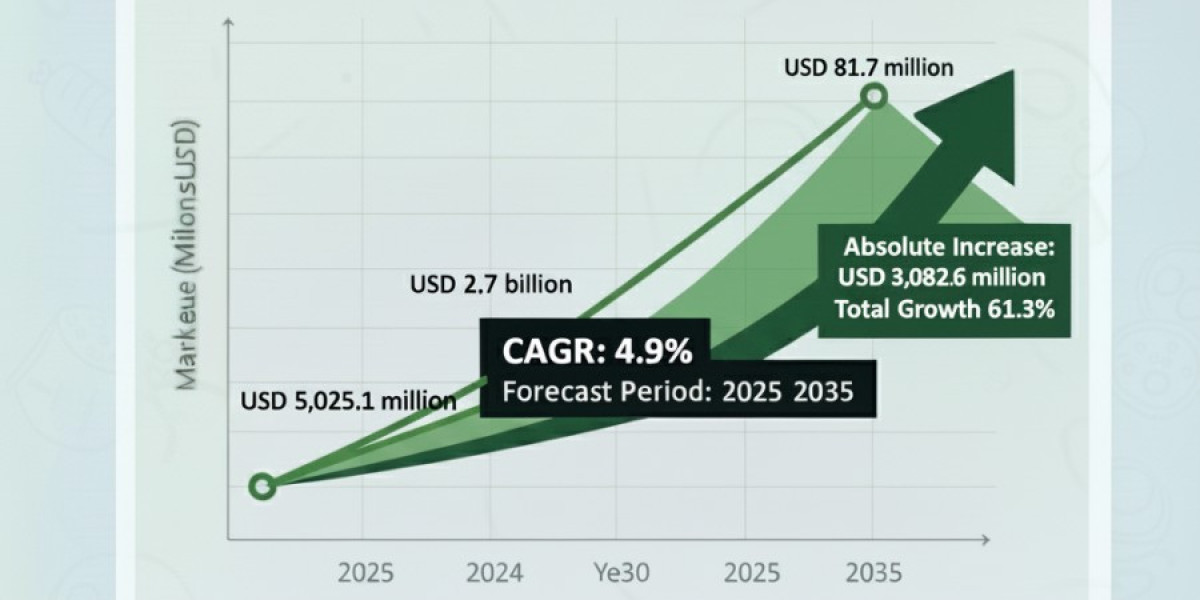

Future Outlook for Virtual Cards

By 2035, the virtual cards industry is expected to experience robust growth due to global digital payment adoption, AI-driven security solutions, and integration with broader financial services. Temporary card usage, seamless online transaction processing, and virtual banking integration will continue to enhance customer convenience and operational efficiency. Regulatory evolution will further ensure secure, scalable, and innovative virtual payment solutions worldwide.

FAQs

What are virtual cards?

Virtual cards are digital payment cards designed for online and secure transactions, often used for temporary or one-time payments.How do virtual cards improve security?

They minimize fraud by generating unique, temporary card numbers and reducing exposure of permanent account details.Which technologies support virtual card adoption?

AI, encryption, tokenization, and virtual banking platforms are key technologies enabling safe and efficient virtual card transactions.

? MRFR BFSI Radar: Real-Time Market Updates ➤

market size of cryptocurrencies